Bank Account

UML Class Diagram Example

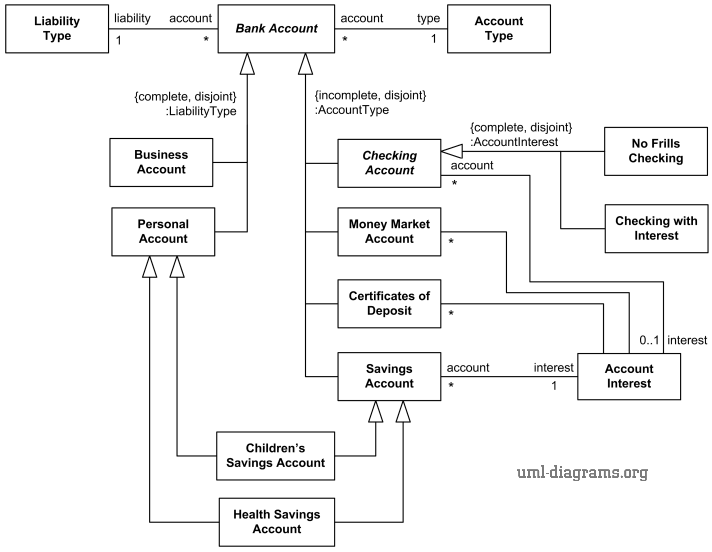

This is an example describing some types of Bank Accounts using UML generalization sets.

Bank accounts could be grouped into UML generalization sets based on different criteria. Example diagram below shows bank accounts split by liability type and account type. These two orthogonal dimensions also have corresponding power types - LiabilityType and AccountType.

Bank account could be used either for personal or for business purposes. To show that it assumes complete coverage and there is no overlapping, we have liability type constraints shown as {complete, disjoint}.

Note, that business owners still may use a personal bank account for their business purposes but it is not recommended primarily because it can affect legal liability of business owner. From the bank's point of view, e.g. when opening an account, these two are two different kinds of accounts.

Another classification of bank accounts is based on related options and features and is shown below as account type generalization set. To show that it this set is incomplete but still there is no overlapping, we have account type constraints shown as {incomplete, disjoint}.

Note, that it is possible to have bank accounts with different combinations of account liability and account type, for example, personal savings account or business money market account.

Bank account taxonomy UML class diagram example with generalization sets and power types.

The purpose of savings account is to allow us to save money. Account holder can make some limited number of deposits and withdrawals per month, while account provides no checks. Bank usually pays interest rate that is higher than that of a checking account, but lower than a money market account or CDs.

A checking account is a bank account that uses checks as a way to withdraw or transfer money from the account - pay bills, buy items, transfer or loan money. Usually banks allow account holders to make withdrawals and deposits through automatic teller machines (ATM). Basic checking accounts, sometimes called No frills accounts, offer a limited set of services. They usually do not pay interest, have lower required minimum balance, may restrict writing and/or depositing more than a certain number of checks per month. Checking accounts with interest have higher required minimum balance but pay interest (based on the average balance maintained), and usually offer a better services, like allowing to write unlimited number of checks. These accounts are sometimes referred to as negotiable order of withdrawal (NOW) accounts.

Money market account or money market deposit account (MMDA) pays interest at a higher rate than the rate paid on savings or checking accounts with interest. Market accounts usually require a higher minimum balance for the account to start earning interest, as compared to checking or savings account. Fund withdrawals allowed per month are very limited.

Certificates of deposit (CDs) also known as time deposits are bank accounts that require the account holder to make a relatively large deposit and leave funds in the account for some agreed amount of time, usually several months or years. There is a penalty for early withdrawal of funds. Because of these restrictions, the interest paid on a CD is usually higher than the interest paid with other types of bank accounts.

Two special cases shown on this UML diagram are Children's Savings Account and Health Savings Account (HSA). These two accounts are both Personal Accounts as well as Savings Accounts. It is shown as multiple inheritance.

Children's Savings Account is a personal savings account that allows children to learn about money savings, interest rates and see what this means in relation to their savings. Some banks require some monthly fee or minimum balance and could charge fees, if an account is inactive or there are too many small deposits.

Health Savings Account (HSA) is a personal savings account that allows individuals covered by high-deductible health plans to receive tax-preferred treatment of money saved for future medical expenses.