Online Shopping - Credit Cards Processing

UML Use Case Diagram Example

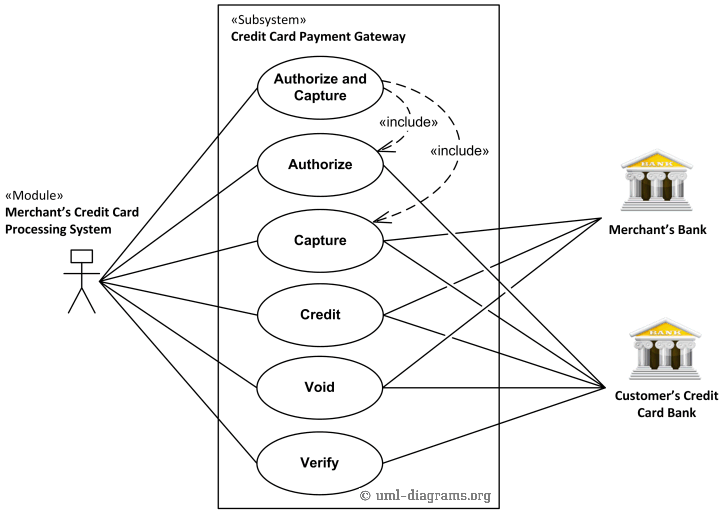

This UML use case diagram example shows some use cases for a system which processes credit cards.

Credit Card Processing System (aka Credit Card Payment Gateway) is a subject, i.e. system under design or consideration. Primary actor for the system is a Merchant’s Credit Card Processing System. The merchant submits some credit card transaction request to the credit card payment gateway on behalf of a customer. Bank which issued customer's credit card is actor which could approve or reject the transaction. If transaction is approved, funds will be transferred to merchant's bank account.

Authorize and Capture use case is the most common type of credit card transaction. The requested amount of money should be first authorized by Customer's Credit Card Bank, and if approved, is further submitted for settlement. During the settlement funds approved for the credit card transaction are deposited into the Merchant's Bank account.

In some cases, only authorization is requested and the transaction will not be sent for settlement. In this case, usually if no further action is taken within some number of days, the authorization expires. Merchants can submit this request if they want to verify the availability of funds on the customer’s credit card, if item is not currently in stock, or if merchant wants to review orders before shipping.

Capture (request to capture funds that were previously authorized) use case describes several scenarios when merchant needs to complete some previously authorized transaction - either submitted through the payment gateway or requested without using the system, e.g. using voice authorization.

UML use case diagram example for a credit cards processing system.

Credit use case describes situations when customer should receive a refund for a transaction that was either successfully processed and settled through the system or for some transaction that was not originally submitted through the payment gateway.

Void use case describes cases when it is needed to cancel one or several related transactions that were not yet settled. If possible, the transactions will not be sent for settlement. If the Void transaction fails, the original transaction is likely already settled.

Verify use case describes zero or small amount verification transactions which could also include verification of some client's data such as address.

You can find excellent resources, documentation, white papers, guides, etc. related to the credit card processing at Authorize.Net - Payment Gateway to Accept Online Payments.